Most state business filing agencies like the Arizona Corporation Commission (ACC) are ministerial entities only and have no regulatory or enforcement authority. In other words, these government entities can make sure any documents you file meet filing requirements, but that’s where their responsibility stops. For example, ACC does not have a requirement to confirm or verify that the information in documents filed with them is correct, only that all the boxes are checked.

State law in Arizona makes it relatively easy to form a limited liability company (LLC) and to make changes to existing LLCs. You can start an LLC entirely online through the Arizona Corporation Commission website and make changes to the governance of the LLC in the same way. Unfortunately, making it easier to navigate government bureaucracy sometimes opens consumers up to vulnerabilities.

Consider the following two scenarios:

Able, Bill, and Carl, owners of ABC LLC, have been having disagreements lately over how their business should operate. Able files an amendment of ABC’s Articles of Incorporation that removes Carl as a member of the LLC without Carl’s knowledge and consent. Able has no legal basis for the removal. The document he filed satisfied the ACC’s filing requirements so it was accepted.

Abby formed ABCorp several years ago but is no longer actively doing business. She did not file dissolution forms or the annual reports, so her corporation is no longer in good standing, although it has not yet been administratively dissolved. Dani discovered the corporation online and brought it back into good standing without Abby’s knowledge. Dani now has authority to act on behalf of ABCorp and plans on applying for a “business loan” soon.

With reports of business fraud and business identity theft on the rise, the ACC is proactively moving toward protecting the public. In May 2025, the ACC Corporations Division voted unanimously to implement several new policy changes and possibly request legislative changes that will combat fraud and deter fraudulent filings. The intent is to make internal agency changes that will serve as a hurdle to bad actors who attempt to commit fraud against Arizona businesses and their owners. The policies for in-person filing will be effective beginning June 16, 2025.

As part of this effort to protect business owners, the ACC Corporation Division is launching a new online filing system later this year. The release date for the online filing system is yet to be determined.

Following is a summary of the new ACC Corporation Division policies:

- Policy 1: Beginning June 16, 2025, people who submit business records in-person will be required to show two forms of ID to ensure they are who they purport to be. Similar requirements will be implemented for online, fax, and mail filings when the new system comes online. The effective date for the online requirements has not yet been defined. This policy will apply to LLCs and corporations.

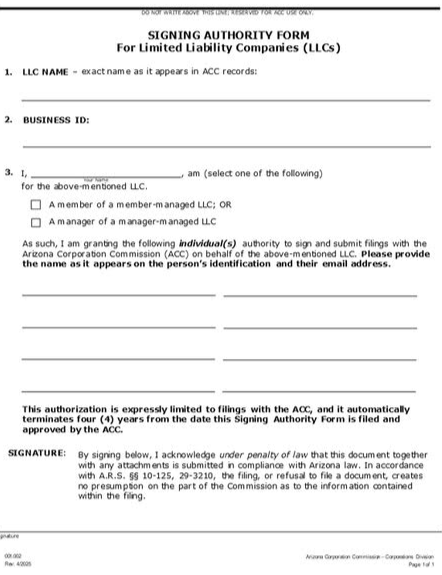

- Policy 2: LLCs (but not corporations) can complete a Signing Authority Form to allow owners to specify who can submit documents on their behalf. Currently, the Signing Authority form can only be created in-person by existing, registered members or managers of the LLC with appropriate identification. Filing this form is voluntary, so ACC will not ask for it nor will it require its filing. ACC will retain these forms and validate all subsequent filings against it. The effective date for this policy was June 16, 2025. The new online filing system may allow for filing this form online, but specifics have not yet been determined.

- Policy 3: Attestation of existence for LLCs. Currently, Arizona LLCs do not have to file annual reports with the ACC, so ACC doesn’t always know if the LLC is still in business. Going forward, the Corporations Division will send electronic notices to LLCs that have not filed any documentation with ACC in the last two years. The notices will request an electronic response to verify that the LLC continues to actively exist and conduct business. If ACC receives no response within 60 days, it will begin an administrative dissolution process on the grounds that the LLC’s information has not been kept current. Corporations must also comply with ACC’s attestation notices. The effective date for Policy 3 for online users has not yet been determined. A copy of the Signing Authority Form follows at the end of this article.

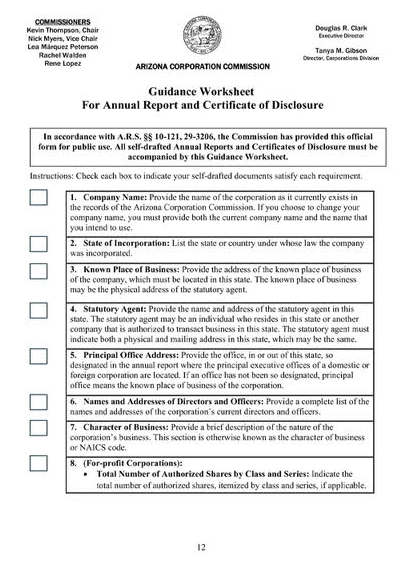

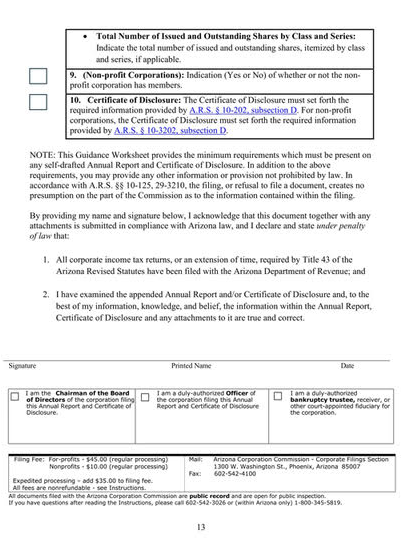

- Policy 4: Rather than use the ACC Annual Report and Certification of Disclosure forms, corporate filers may use their own forms if they meet statutory requirements and include the ACC’s guidance worksheet. A copy of the ACC guidance worksheet follows at the end of this article. It is not yet available on the ACC website.

The Arizona Corporation Commission designed these policies to improve customer experience and to help protect business owners from fraudulent filings. Let us know if you have questions about the new policies or if we can help you with your ACC filings.

About this Author

Adam specializes in international tax planning and analysis. Since 2012 he has coordinated offshore compliance submissions, international tax training relating to foreign pension plans, foreign investment in US property, and general foreign compliance. In addition, in conjunction with legal counsel, he assists international families regarding planning, entity structure, and transaction analysis.

Join our newsletter for insights and information that matter to you or your business